Solutions

Products

-

Primary mobile crushing plant

-

Independent operating combined mobile crushing station

-

Mobile secondary crushing plant

-

Fine crushing and screening mobile station

-

Fine crushing & washing mobile station

-

Three combinations mobile crushing plant

-

Four combinations mobile crushing plant

-

HGT gyratory crusher

-

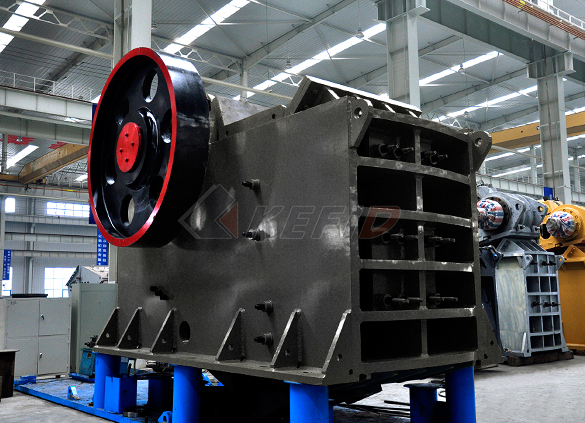

C6X series jaw crusher

-

JC series jaw crusher

-

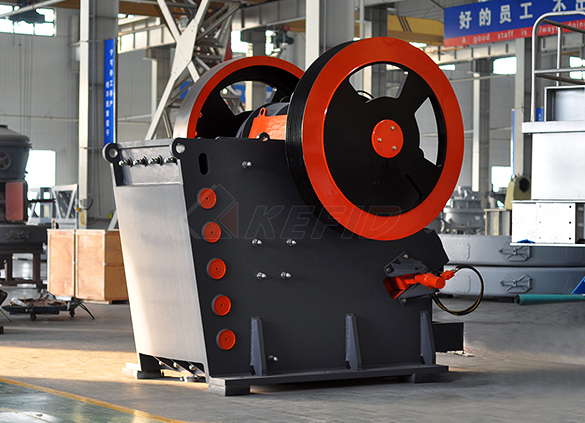

Jaw crusher

-

HJ series jaw crusher

-

CI5X series impact crusher

-

Primary impact crusher

-

Secondary impact crusher

-

Impact crusher

-

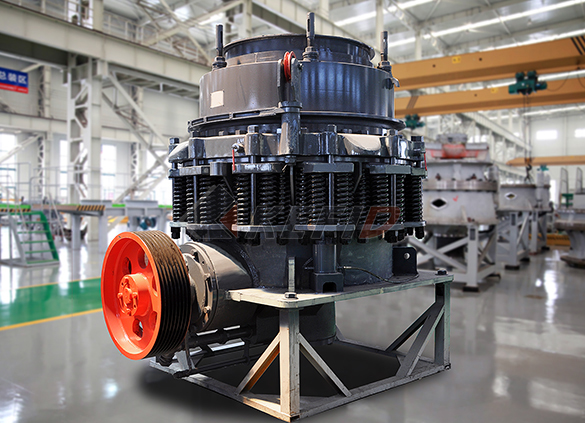

HPT series hydraulic cone crusher

-

HST hydraulic cone crusher

-

CS cone crusher

-

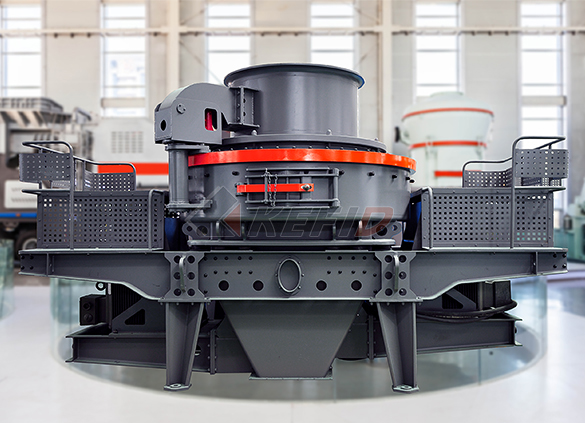

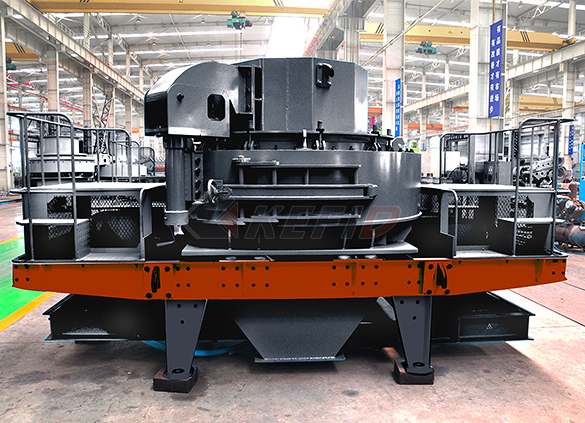

VSI6S vertical shaft impact crusher

-

Deep rotor vsi crusher

-

B series vsi crusher

-

Vertical grinding mill

-

Ultra fine vertical grinding mill

-

MTW european grinding mill

-

MB5X158 pendulum suspension grinding mill

-

Trapezium mill

-

T130X super-fine grinding mill

-

Micro powder mill

-

European hammer mill

-

Raymond mill

-

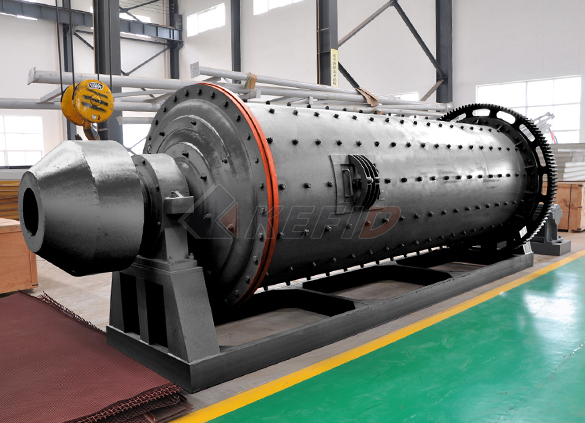

Ball mill

-

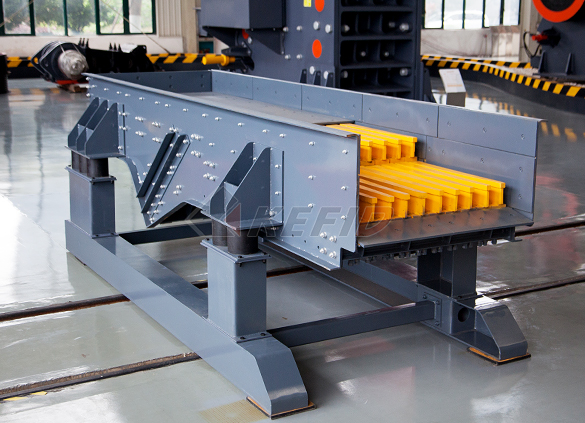

GF series feeder

-

FH heavy vibrating feeder

-

TSW series vibrating feeder

-

Vibrating feeder

-

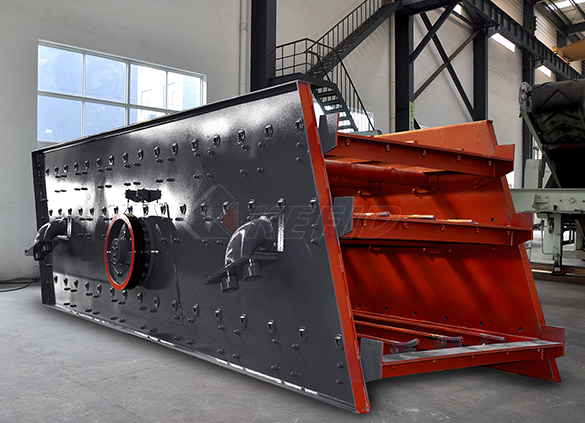

Vibrating screen

-

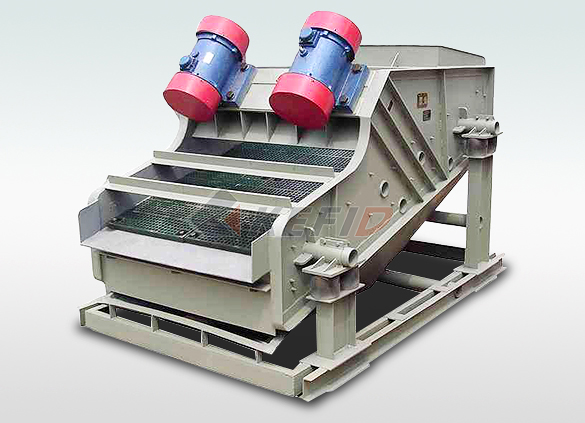

S5X vibrating screen

-

Belt conveyor

-

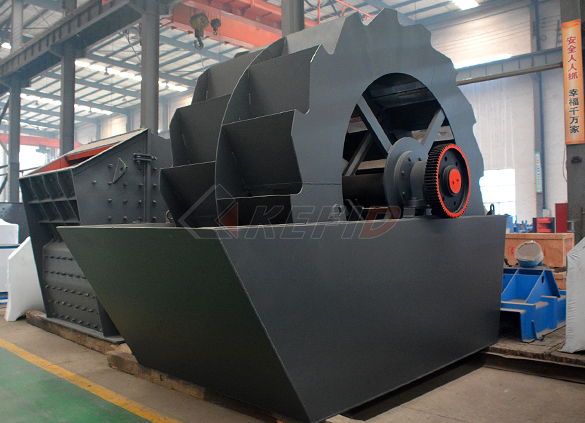

Wheel sand washing machine

-

Screw sand washing machine

-

Rod mill

-

Dryer

-

Rotary kiln

-

Wet magnetic separator

-

High gradient magnetic separator

-

Dry magnetic separator

-

Flotation machine

-

Electromagnetic vibrating feeder

-

High frequency screen

Corporate Finance Minicase: Bullock Gold Mining,

The expected cash fl ows each year from the mine are shown in the table Bullock Mining has a 12 percent required return on all of its gold mines QUESTIONS Construct a spreadsheet to calculate the payback period, internal rate of return, modified internal rate of return, and net present value of the proposed mineBULLOCK GOLD MINING Seth Bullock, If the company opens the mine, it will cost $650 million today, and it will have a cash outflow of $72 million nine years from today in costs associated with closing the mine and reclaiming the area surrounding it Construct a spreadsheet to calculate the payback period, internal rate of return FINANCE CASE STUDY: Construct a spreadsheet to The expected cash flows each year from the mine are shown in the table on this page Bullock Mining has a 12 percent required return on all of its gold mines QUESTIONS 1 a spreadsheet to calculate the payback period, internal rate of return, modified internal rate of return, and net present value of the proposed mine 2CHAPTER CASE BULLOCK GOLD MINING Seth Bullock,

The Bullock Gold Mining Assignment Paper My Best

The Bullock Gold Mining case can be analyzed by the use of Payback Period, NPV, IRR, and modified IRR From the calculations in the appendix, all the above calculations show positive results to imply that the project is worth investing in Therefore, the Ballock Gold mine is a viable project References Cornett, M, Adair, T, Nofsinger, J Bullock Gold Mining Mini Case Finance Bullock Gold Mining The payback period for Bullock Gold Mining in the book does not have a required time period Usually, a company has a prespecified length of time as a benchmark The decision rule is to invest in projects that pay sooner or have a shorter payback periodBullock Gold Mining Mini Case Finance Free Essays CHAPTER CASE BULLOCK GOLD MINING 1 Construct a spreadsheet to calculate the payback period, internal rate of return, modif rate of return , and net present value of the proposed mine Year Cash Flow 0$650,000,000 1 80,000,000 2 121,000,000 3 162,000,000 4 221,000,000 5 210,000,000 6 154,000,000 7 108,000,000 8 86,000,000 972,000,000 Required return 12% After the Chapter III Case Bullock Gold Mining CHAPTER CASE

BULLOCK GOLD MINING Questions Plus Answers

Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan Dority, the company’s geologist, has just finished his analysis of the mine site He has stimated that the mine would be productive for eight years, after which the gold MINICASE Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan Dority, the company’s geologist, has just fi nished his analysis of the mine site He has estimated that the mine would be productive for eight years, after which the gold would be completely mined Dan has taken an estimate of the gold deposits to Alma Garrett, the company’s fi BULLOCK GOLD MININGpptx BULLOCK GOLD Corporate Finance Case Study : Bullock Gold Mining 1 LOGOLOGOBullock Gold MiningCorporate Finance Case StudyUun Ainurrofiq Yoong Khai Hung Khatereh Azarnoor Aliakbar Corporate Finance Case Study : Bullock Gold Mining

Solved: Cost Of Capital Capital Budgeting Mini Case

Cost of Capital Capital Budgeting Mini Case Instrucciones: Favor de enseñar todo el procedimiento No se aceptan respuestas sin procedimientos Bullock Gold Mining Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan Dority, the company's geologist, has just finished his analysis of the mine siteBULLOCK GOLD MINING Seth Bullock, If the company opens the mine, it will cost $650 million today, and it will have a cash outflow of $72 million nine years from today in costs associated with closing the mine and reclaiming the area surrounding it Construct a spreadsheet to calculate the payback period, internal rate of return FINANCE CASE STUDY: Construct a spreadsheet to The expected cash flows each year from the mine are shown in the table on this page Bullock Mining has a 12 percent required return on all of its gold mines QUESTIONS 1 a spreadsheet to calculate the payback period, internal rate of return, modified internal rate of return, and net present value of the proposed mine 2CHAPTER CASE BULLOCK GOLD MINING Seth Bullock,

The Bullock Gold Mine Case Study Essays

The payback period is 4 years + 003 years = 403 years (Appendix B) The internal rate of return is an alternative to the payback period With the excel sheet, the formula is =IRR(values) and the values is 1472% for the proposed Bullock Gold Mine (Appendix B) The expected cash flows each year from the mine are shown in the table attached Bullock Mining has a 12 percent required return on all if its gold mines 1 Construct a spreadsheet to calculate the payback period, internal rate of return, modified internal rate of return, and net present value of the proposed mine 2Bullok Gold Mining Case Essay 269 Words1 Construct a spreadsheet to calculate the payback period, internal rate of return, modified internal rate of return, and net present value of the proposed mine 2 Based on your analysis, should the company open the mine? 3 Bonus question: Most spreadsheets do not have a builtin formula to calculate the payback period Write a VBA script that calculates the payback period for a project[Solved] Seth Bullock, the owner of Bullock Gold

Solved: CHAPTER CASE Bullock Gold Mining Sebo Eth

The expected cash flows each year from the mine are shown in the nearby table Bullock Gold Mining has a 12 percent required return on all of its gold mines QUESTIONS 1 Construct a spreadsheet to calculate the payback period, internal rate of return, modified internal rate of return, and net present value of the proposed mine 2 MiniCase Study: Bullock Gold Mining Seth Bullock, the o wner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan Dority, the company's geologist, has just finished his analysis of the mine site He has estimated that the mine would be more productive for either years, after which the gold would be completely minedMiniCase Study: Bullock Gold Mining BrainMass Bullock Mining has a 12 percent required return on all of its gold mines QUESTIONS Construct a spreadsheet to calculate the payback period, internal rate of return, modified internal rate of return, and net present value of the proposed mine2019 November Muhammad Syarif

Seth Bullock, the owner of Bullock Gold Mining, is

Bullock Gold Mining has a 12 percent required return on all of its gold mines Required: Construct a spreadsheet to calculate the payback period, internal rate of return, modified internal rate of return, and net present value of the proposed mine 1 Answer to CHAPTER CASE BULLOCK GOLD MINING Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan Dority, the company’s geologist, has just finished his analysis of the mine site He has estimated that the mine would be productive for eight years, after which the(Solved) CHAPTER CASE BULLOCK GOLD MINING BULLOCK GOLD MINING Seth Bullock, If the company opens the mine, it will cost $650 million today, and it will have a cash outflow of $72 million nine years from today in costs associated with closing the mine and reclaiming the area surrounding it Construct a spreadsheet to calculate the payback period, internal rate of return FINANCE CASE STUDY: Construct a spreadsheet to

Bullok Gold Mining Case Essay 269 Words

The expected cash flows each year from the mine are shown in the table attached Bullock Mining has a 12 percent required return on all if its gold mines 1 Construct a spreadsheet to calculate the payback period, internal rate of return, modified internal rate of return, and net present value of the proposed mine 2Bullock Gold Mining Case Solution Case Solution And Bullock Gold Mining Case Study Solution Seth Bullock the owner of Bullock Gold Mining is assessing a brand new cash cow in South Dakota Dan Dority the business's geologist has actually simply completed his analysis of the mine websiteBullock Gold Mining Mini Case Finance Bullock Gold Mining The payback period for Bullock Gold Mining in the Solution For Bullock Gold Mining Case ExcelBULLOCK GOLD MINING Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South DakotaDan Dority, the company’s geologist, has just finished his analysis of the mine site He has estimated that the mine would be productive for eight years, after which the gold CASH FLOWS AND FINANCIAL STATEMENTS CASE

CHAPTER CASE BULLOCK GOLD MINING

chapter case bullock gold mining seth Bullock, the owns of Bullock Gold Muting, is evaluating a new gold mine in South Dakota Dan Daily the company’s geologist, has just finished his analysis of the mine sheik has estimated that the mine would be podoctive for eight years, after which the gold would be completely musedThe expected cash flows each year from the mine are shown in the table on this page Bullock Mining has a 12 percent required return on all of its gold mines Year Cash Flow 1 80,000,000 2 121,000,000 3 162,000,000 4 221,000,000 5 210,000,000 6 154,000,000 7 108,000,000 8 86,000,000 QUESTIONS 1BUSN 379 Week 6 Case Study BULLOCK GOLD MiniCase Study: Bullock Gold Mining Seth Bullock, the o wner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan Dority, the company's geologist, has just finished his analysis of the mine site He has estimated that the mine would be more productive for either years, after which the gold would be completely minedMiniCase Study: Bullock Gold Mining BrainMass

2019 November Muhammad Syarif

Bullock Mining has a 12 percent required return on all of its gold mines QUESTIONS Construct a spreadsheet to calculate the payback period, internal rate of return, modified internal rate of return, and net present value of the proposed mine BULLOCK GOLD MINING Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan Dority, the companys geologist, has just finished his analysis of the mine site He has estimated that the mine would be productive for eight years, after which the gold would be completely minedBUSN 379 Week 6 Case BULLOCK GOLD MINING 1 Answer to CHAPTER CASE BULLOCK GOLD MINING Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan Dority, the company’s geologist, has just finished his analysis of the mine site He has estimated that the mine would be productive for eight years, after which the(Solved) CHAPTER CASE BULLOCK GOLD MINING